14+ tax proration calculator

Heat of fusion calculator. Calculate Ratio in Excel - Example 1 A calculating ratio in excel is.

How To Prorate Real Estate Taxes Pocketsense

Iowa Tax Proration Calculator Todays date.

. Annual property tax amount. You then multiply the daily rent. Annual property tax amount.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Proration is inclusive of both specified dates. The Tax Proration Calculator - Calculates the property tax owed at the closing of a real estate transaction.

Then divide that number by the number of days in the year. Figuring the prorated tax for the buyers and sellers is a five-part process. This is an easy formula that you can use to quickly get the prorated property tax that you can advise to your.

This tool is used to determine whether the buyer or the seller is owed tax money. 30 7 1 move in day 24. Calculate the daily tax rate by dividing the annual tax rate by the days in the year 365 or 366 for leap years.

The Prorated rent for them in this example then would be 64008. The sellers should be responsible for the amount of unpaid. 31440 Northwestern Highway Suite 300 Farmington Hills MI 48334 Phone.

May 2021 Pay 2022 First Half Taxes Paid. 800 30 2667. 248 205-4108 Contact UsContact Us.

Property tax and proration calculators. How A lot Is Property Tax. If you wish to prorate over a period not.

Property tax proration. Proportion Calculation - X sellers of days total amount tax 365 days. Annual property tax amount.

Iowa Tax Proration Calculator Todays date. Prorate a specified amount over a specified portion of the calendar year. Property Tax Proration Calculator.

Floor area ratio calculator. In order to calculate the prorated rent amount you must take the total rent due divide it by the number of days in the month to determine a daily rent amount. November 2021 Pay 2022 Second Half Taxes Paid.

November 2021 Pay 2022 Second Half Taxes Paid. One mill is the same as 1 of tax for each 1000 in assessed worth. Iowa Tax Proration Calculator.

To calculate the taxes to be prorated multiply the yearly taxes by 105. The Tax Proration Calculator - Calculates the property tax owed at the closing of a real estate transaction. 248 594-3839 Fax.

Basics Of Property Taxes Mortgagemark Com

Your Guide To Prorated Taxes In A Real Estate Transaction

How To Compute Real Estate Tax Proration And Tax Credits Illinois

Essential Real Estate Law Property Tax Proration Acuna Law Offices Real Estate Investment Law

Negotiating Your Home Purchase Dregerlaw Chicago Attorney Commercial Law

Property Tax Prorations Case Escrow

Closing Calculators Clear To Close

Real Estate Legal Pro Tip Before Signing Contract Carefully Consider Tax Proration Language When Contract Price Exceeds Auditor S Valuation Finney Law Firm

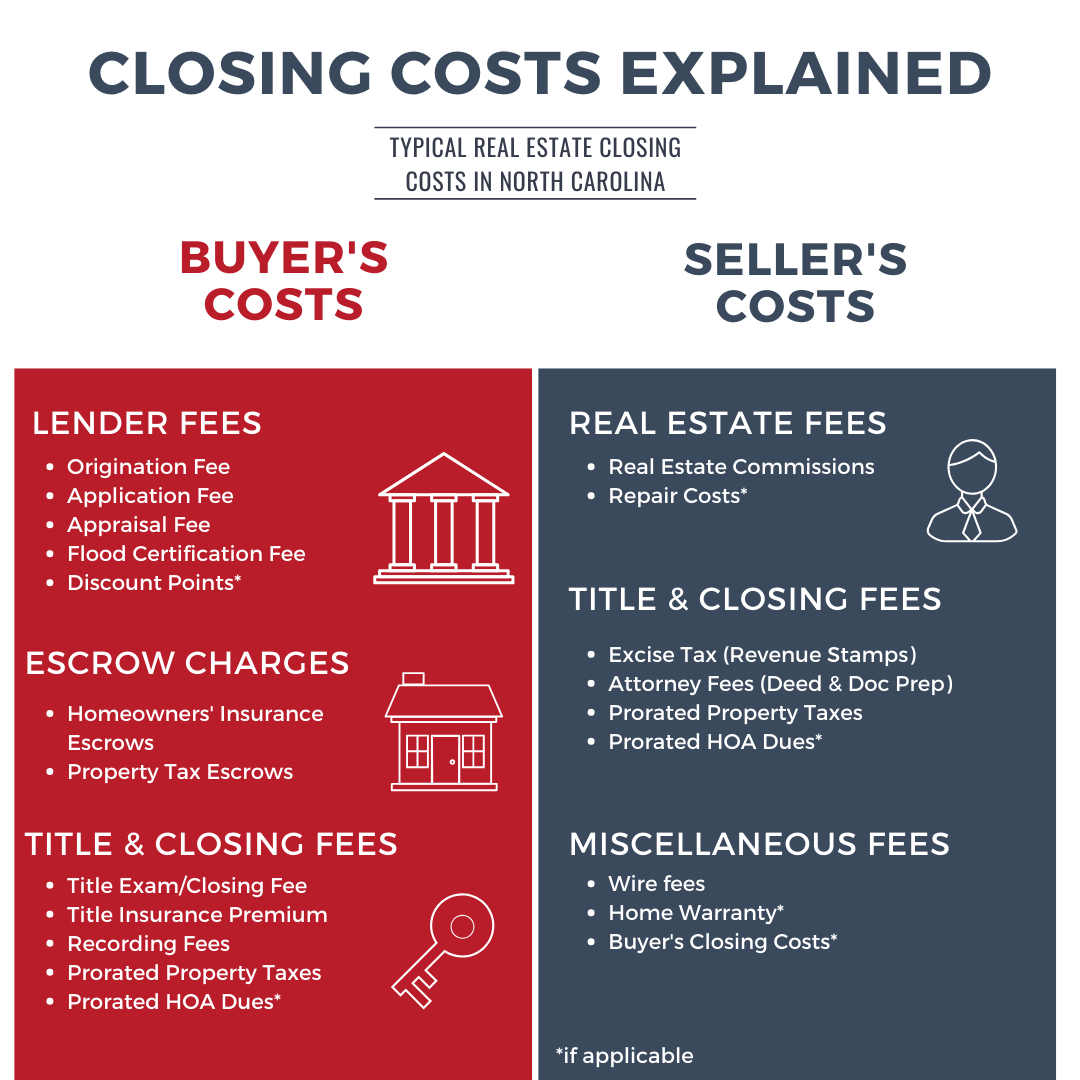

How To Calculate Closing Costs On A Nc Home Real Estate

Netsheet Calculator Kidwell Cunningham Ltd

Tax Proration Agreement Fill Online Printable Fillable Blank Pdffiller

How Are Property Taxes Handled At A Closing In Florida

California Property Taxes Viva Escrow 626 584 9999

Real Estate Math Video 6b Prorate Real Estate Taxes 365 Day Method Real Estate Prep Exam Youtube

Property Tax Abatements

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Prorating Real Estate Taxes In Michigan